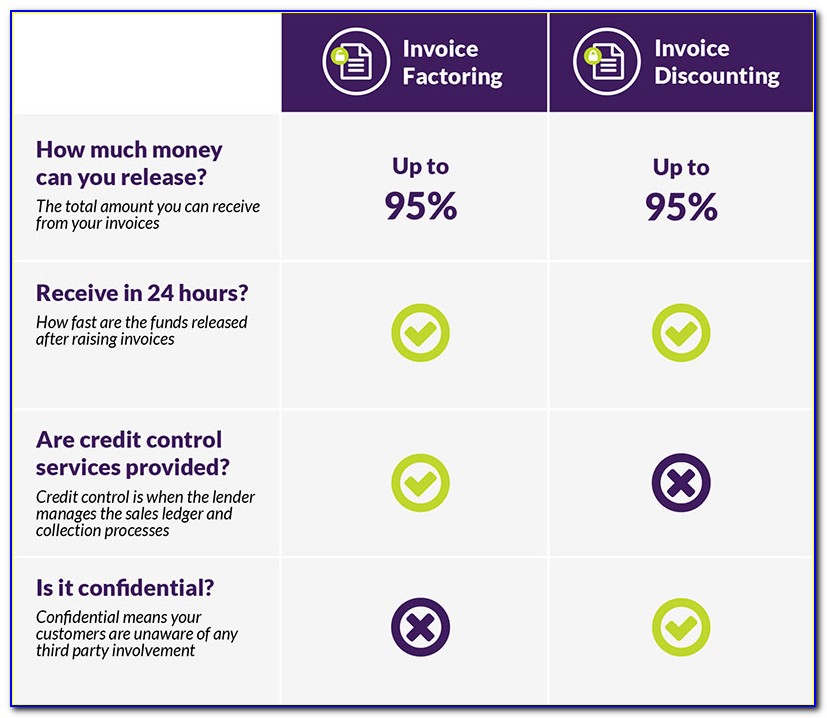

Market Invoiceįounded in 2011, MarketInvoice is a relatively new entrant to the market but it has already established a reputation for being one of the best providers in the industry. It’s also very accessible with a 24/7 client online service and 19 local offices around the UK and Ireland. It also has a four-star rating on the online review site Trustpilot – an impressive score given that it’s one of the largest independent invoice finance providers in the world. In 2017, Bibby won the coveted ‘Best Factor and Invoice Discounter’ at the National Association of Commercial Finance Brokers Awards. With a minimum turnover requirement of just £100k, it is accessible to small businesses and has a particular reputation for working with construction and recruitment firms. Operating since 1982, Bibby Financial Services has worked with more than 7,000 businesses and earned a reputation as one of the UK’s leading invoice finance providers. *All figures are accurate at the time of writing (December 2018). So, we’ve put together a guide to some of the best invoice finance providers to help you consider your options. With so many invoice finance providers competing for your business, it can be difficult to know where to start. Our Selection of the Best Invoice Finance and Factoring Companies in the UK We have a lot of experience with alternative finance and can help you find the lender right for your situation. Some lenders are best for speed, others for customer service, others for current rates.Īs with any compelling offer, you need to due your due diligence on the fine print, or simply ask us for help. Of course, since all businesses are different, each borrowers situation will require a unique solution. The increased level of competition has brought down the costs, drastically improved service levels and made invoice finance a viable option for many UK businesses. There are now more than 50 invoice finance companies in the UK. Hitachi Capital UK Which UK Invoice Finance Company is Best?Īs the popularity of invoice finance has increased, so has the number of providers competing for your business.Our Selection of the Best Invoice Finance and Factoring Companies in the UK.

By taking advantage of factoring a startup can ensure they won’t run short of cash, which could slow down operations. Invoice factoring can help with funding by speeding up cash flow without the long wait for an invoice to pay. Being a startup involves a lot of risk, time constraints, staffing demands, and challenges obtaining funding. Startups bring us some of our most creative innovations.

0 kommentar(er)

0 kommentar(er)